Patient Care or Profit Margin: The Private Equity Paradox

Learning from the Steward Health Crisis

In the high-stakes arena of healthcare policy, an $880 billion budget cut looms like a financial guillotine over federal programs—with Medicaid squarely in the crosshairs. This isn't just another budget negotiation; it's a potential dismantling of a lifeline for millions of vulnerable Americans.

Medicaid isn't just an insurance program—it's a critical safety net that covers more than 72 million people, representing over one in five Americans. Its reach is profound: supporting children (2 in 5), senior citizens, people with disabilities, adults with mental illness, nursing home residents (60%), and financing approximately 40% of all births in the United States.

Any discussion of Medicaid cuts must reckon with this stark reality: these proposed reductions aren't abstract budgetary lines, but a direct threat to the most fundamental healthcare needs of our most vulnerable populations.

Healthcare as a business:

Before diving in, there are a couple premises that are important to share about the US healthcare system. This not just patients, doctors, nurses, hospitals, it’s a high-stakes financial ecosystem.

1. Economic behemoth: annual spending in 2021of $4.3 trillion dollars

2. Major employer: comprising roughly 14% of the US workforce

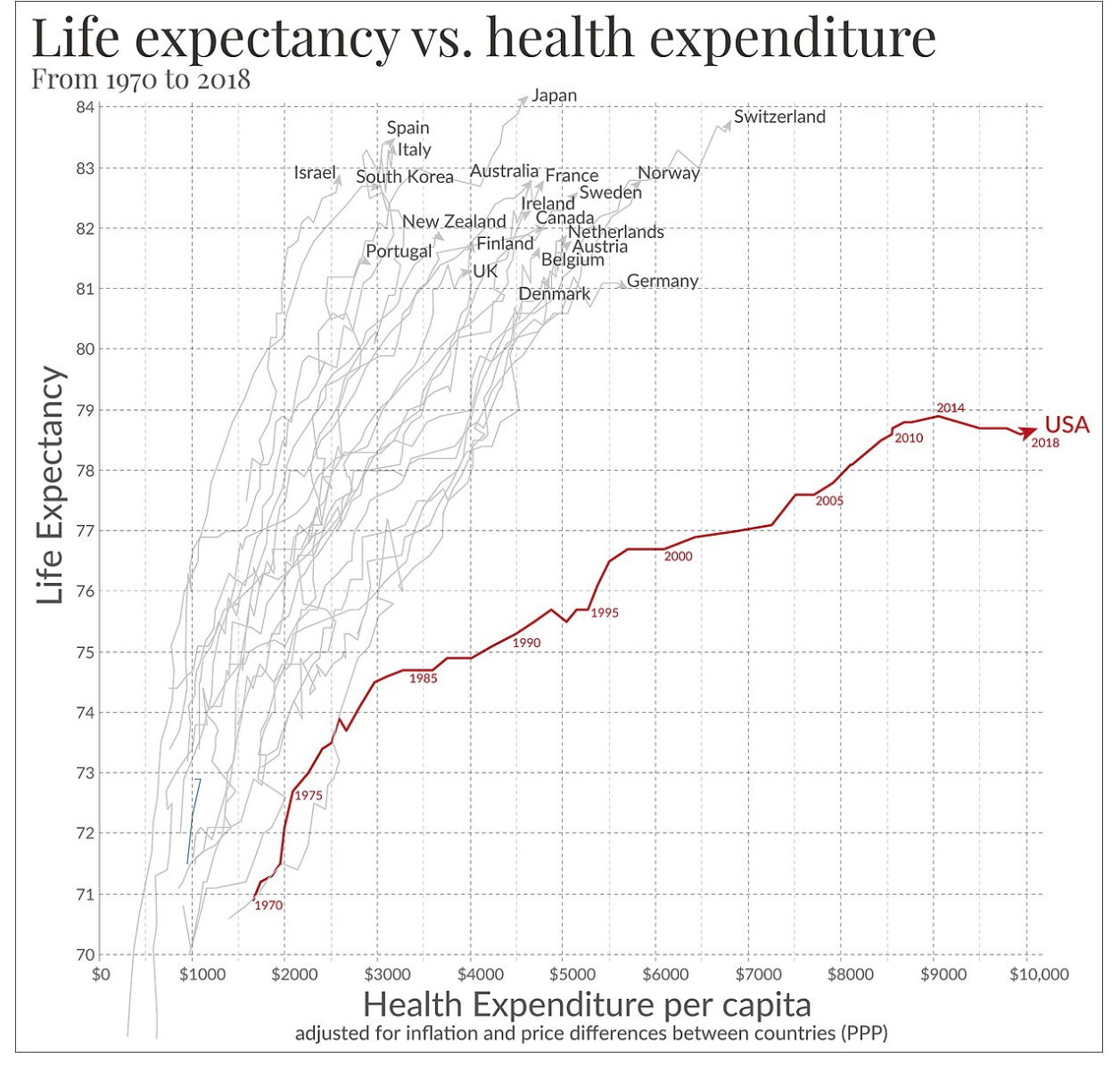

3. Global Outlier: The US spends dramatically more on healthcare than any other high-income countries (with no corresponding increased life expectancy)

4. Complex structure: A Byzantine network of providers, payers (health plan providers, insurance companies), patients, pharmaceutical companies and medical device manufacturers, the list goes on…

The system’s complexity breeds inefficiency. Administrative costs ballon to roughly 25% of total healthcare spending, nearly double the 12% seen in other high-income countries. It is both bureaucratic bloat and systemic extraction of value that compromises patient care. It gets even more complicated due to lack of cost transparency, but the insurance system is its own discussion, and we digress.

As Dr. Nick Sawyer incisively observed: “Healthcare organizes doctors and patients into a system where that relationship can be financially exploited and as much money extracted as often as possible by hospitals, clinics, health insurers, the pharmaceutical industry and medical device manufacturers”.

What is private equity?

I’ll briefly explain the concept of private equity (PE) before sharing the implosion that is ongoing in Massachusetts because of private equity ownership of a large healthcare system (that expanded nationally and internationally).

Private equity firms are essentially financial alchemists. They raise capital from investors, then acquire companies with one laser-focused mission: turning businesses into investment returns. The playbook is simple: buy low, optimize aggressively, sell high. The north star is always the same—maximum return on investment, by any means necessary. Am I being flippant, yes. Is private equity considerably more complex, yes. But for our purposes, this is a decent explanation for non-business brains (ignore the pitch at the end).

As a physician, I understand the allure of bringing business expertise into healthcare. Coming out of medical school and residency, I'll admit our training offers minimal insight into healthcare's financial mechanics. In the emergency department, I'm largely sheltered from the intricate financial decisions that keep a practice solvent. Just as I consult experts for complex medical questions outside my specialty, seeking business guidance in healthcare initially seems sensible. The logic is straightforward: let business-savvy consultants optimize operations while healthcare workers focus on patient care.

Yet the fundamental contradiction emerges perfectly in Meredith Rosenthal's insightful statement: "The pitch is that corporations can raise capital and invest in improving the business – quality of care, operations, professional management – in a way non-profits can't. But the challenge is that because health care is so important, the public expects these corporations to prioritize public interest over profits. And that's not what they're built to do".

Steward Healthcare Implosion

The Steward Healthcare story reads like a case study in how private equity cannibalizes essential healthcare infrastructure—a narrative that begins with promise and ends in catastrophic failure.

In 2010, Cerberus Capital Management seemed like a healthcare hero. They purchased Caritas Christi Health Care's six hospitals for $246 million, assuming $200 million in liabilities and promising $400 million in investment. To many, this looked like a lifeline for hospitals that might have otherwise closed, serving a critical Medicaid population in eastern Massachusetts.

The financial machinations began quickly. By 2016, Steward sold hospital properties for $1.2 billion, implementing a sale-leaseback agreement that allowed them to expand to 26 hospitals while generating immediate cash. But the cracks were already showing:

2017: $322 million in operating losses

2018: $270 million in operating losses

2020: Cerberus miraculously extracted $800 million in profit, sold Steward

The patient-endangering descent accelerated:

2021: Ongoing losses, unpaid bills to staffing companies and landlords—yet still paying $111 million in dividends to investors (Dr. De La Torre acquired a 190 foot yacht for an estimated $40 million)

October 2023: A 39-year-old new mother died after critical medical devices were unavailable (information that wasn’t disclosed to her family)

Dialysis providers refused service at Steward hospitals

Medical device companies began repossessing equipment due to non-payment

Nursing staffing company debt ballooned from $7 million to $40 million

By May 2024, the inevitable happened: Chapter 11 bankruptcy.

The most damning indictment? Between June 2019 and June 2024, federal inspectors cited Steward for "immediate jeopardy" conditions so severe that patients died, were injured, or placed at grave risk—a level of negligence that would typically threaten Medicare reimbursements. All while workers across the care team had “consistently raised concerns about the precarious position hospital management had placed both patients and caregivers” as noted by a memo sent by the United Healthcare Workers East, a union representing 5000 members working at Steward’s Massachusetts sites.

What began as a potential rescue of struggling hospitals transformed into a predatory extraction of value, with vulnerable patients bearing the ultimate cost.

Private Equity's Healthcare Footprint:

The repercussions across many domains including patient care, care quality, provider support and systemic costs are profound and not living up to the promises of increased efficiency.

Hospital-Acquired Conditions: increase upwards of 25% (falls, central line infections)

Hospital Ratings: Consistent decline in overall quality, patient experience, and likelihood of recommendation

Loss of access: Critical but less profitable services like pediatrics and preventative care systematically gutted

Nursing and Long-Term Care Catastrophe:

Nursing Homes Under PE: Higher mortality rates, increased emergency department visits

Staffing Ratios: Dramatically reduced to boost short-term profits

Medicare Costs: Paradoxically rising while care quality plummets

Workforce Destruction:

Physician Exodus: Increased likelihood of leaving PE-owned practices

Staffing Disruptions: Massive unpaid bills (like Aya's $40 million) creating long-term hiring challenges, staff leaving when required supplies are not present

Patient-Physician Relationships: Systematically undermined by constant turnover and cost-cutting

Systemic Consequences: The real damage extends beyond individual institutions. PE's approach creates a cascading failure:

For-profit insurers layer additional cost extraction

Critical healthcare infrastructure is treated as a financial instrument, not a human service

The promise of business efficiency has revealed itself as nothing more than a predatory mechanism for value extraction—with patients, healthcare workers, and community health paying the ultimate price.

Why are we surprised? The private equity firms engaging with healthcare are behaving exactly as they are supposed to because their obligation is not to the patient, it’s to maximize profit. It’s like being shocked that water is wet.

Is the current system better?

The Steward Healthcare implosion is not an aberration—it's a symptom of a deeper systemic malaise. Our current healthcare landscape is a complex battlefield where financial incentives consistently trump patient care, with all the subtlety of a used car salesman trying to upsell an extended warranty on your appendectomy.

The numbers tell a stark truth. Non-profit hospitals, often portrayed as more altruistic, provide only marginally more charity care than their for-profit counterparts—a mere 2.95% compared to 2.6% of total expenses. Community benefit obligations ring hollow when the fundamental economic pressures remain unchanged.

In the emergency department, these abstract discussions become viscerally real. I've navigated the increasingly fragmented healthcare landscape, coordinating transfers of critically ill pediatric patients across state lines, searching desperately for available intensive care beds. Each transfer represents more than a medical logistics challenge—it's a profound failure of a system designed to heal but increasingly structured to monetize.

We need a radical reimagining of healthcare—not as a marketplace, but as a fundamental human right. This requires dismantling the current stakeholder model that transforms patients into profit centers. We need a system that prioritizes prevention, comprehensive care, and community health over quarterly returns.

Reform cannot be cosmetic. It must be systemic, addressing the root causes that allow both private equity predators and non-profit institutions to prioritize financial survival over patient well-being and healthcare workers’ ongoing sacrifice and moral injury. The path forward demands uncomfortable conversations about restructuring healthcare financing, redefining the role of medical institutions, and centering human care in our most critical social infrastructure.

If you want more in-depth learning, there is an excellent podcast from The Dose from the Commonwealth Fund about private equity’s role in healthcare.

If you have any brilliant ideas for healthcare reform, we’re all ears! Please comment below. Also - that was heavy, so dog.

Disclaimer: The content provided in Couch Nap is for educational and entertainment purposes only. It is not intended as medical advice, diagnosis, or treatment. It does not establish a doctor-patient relationship. Always consult with your healthcare professional regarding any medical concerns or decisions. The views and opinions expressed here are our own and do not represent the positions, policies, or opinions of our employers or any affiliated organizations. While we strive for accuracy, the information presented here may not apply to your unique situation.

Been watching the PE in healthcare debacle unfold for years. It started with the nursing homes/SNFs, etc - purchased as much for the real estate as for the facility. Patient care/quality of care/well being of staff - not valued.

I wonder about any relationships between PE ownership and the increased violence against healthcare workers